Irs Business Gift Limit 2024 Limit

Irs Business Gift Limit 2024 Limit – the IRS established a gift tax limit of $17,000 per recipient. This means that during 2023, you could give up to $17,000 to any number of individuals without incurring gift tax. As for 2024, the limit . Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient Large and complex financial, business or real .

Irs Business Gift Limit 2024 Limit

Source : www.chase.com2024 Increases in IRS Gift Allowances

Source : www.linkedin.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

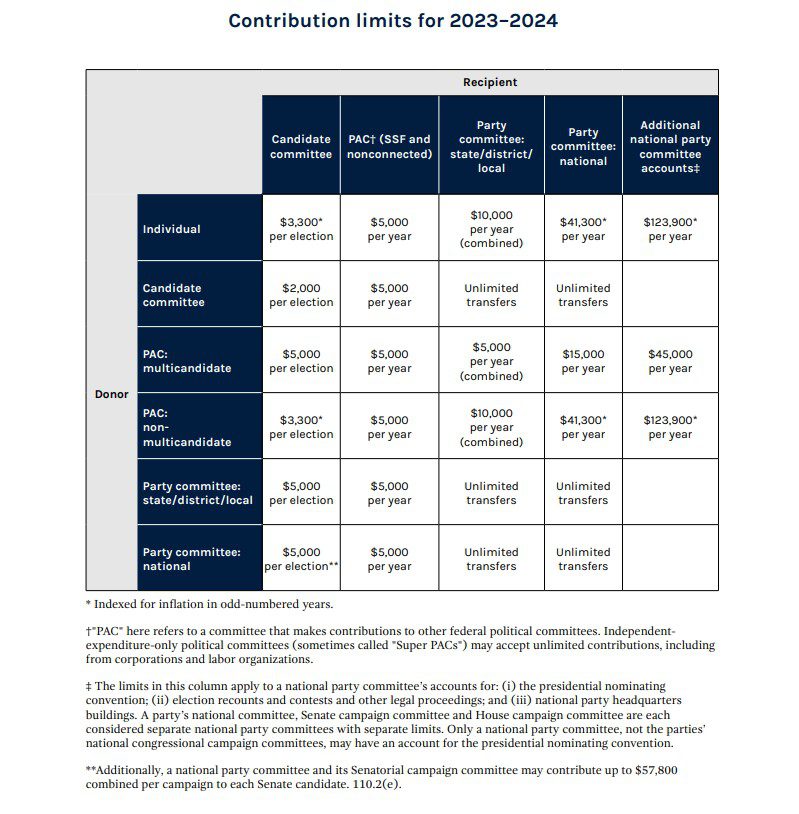

Source : quickbooks.intuit.com2023 Inflation Adjustments and FEC Contribution Limits Harmon Curran

Source : harmoncurran.com401k Contribution Limits For 2024

Source : thecollegeinvestor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comCadence Bank | Tupelo MS

Source : www.facebook.comGift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset

Source : smartasset.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgGift Tax, Explained: 2024 Exemptions and Rates | SmartAsset

Source : smartasset.comIrs Business Gift Limit 2024 Limit Retirement Planning: Contribution Limits for 2024 | Chase: Most taxpayers, from individuals to married couples, are unfamiliar with the concept of the gift tax, which the government assesses on certain transfers of money or other assets from one person . Need to know how to start a business this year? Our guide takes you through a dozen steps that will make the process straightforward and manageable. .

]]>